Leveraging Warden's Collateral at Risk simulations for effective risk management in lending protocols

The Warden Finance website provides a tool called Collateral at risk which helps understand the impact of asset prices changes and governance parameters changes across one or multiple protocols. In this blog post, we will explain how the Collateral at Risk feature works and provide some use cases on how to use it to improve risk analysis. Let's dive in and explore this feature.

To access the Collateral at Risk feature, visit https://www.warden.finance/collateral-at-risk.

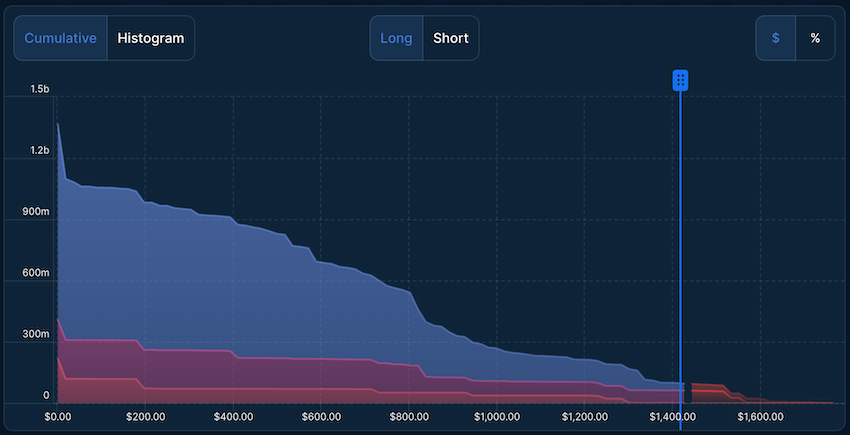

Users are required to select one or multiple assets and their simulated prices. You can input the data directly or drag the cursor on the chart and then click the "Run Simulation" button.

Please note that selecting multiple assets will cause the simulation to recompute all of the accounts, resulting in significantly slower performance. Expect simulation times in the range of 30-60 seconds.

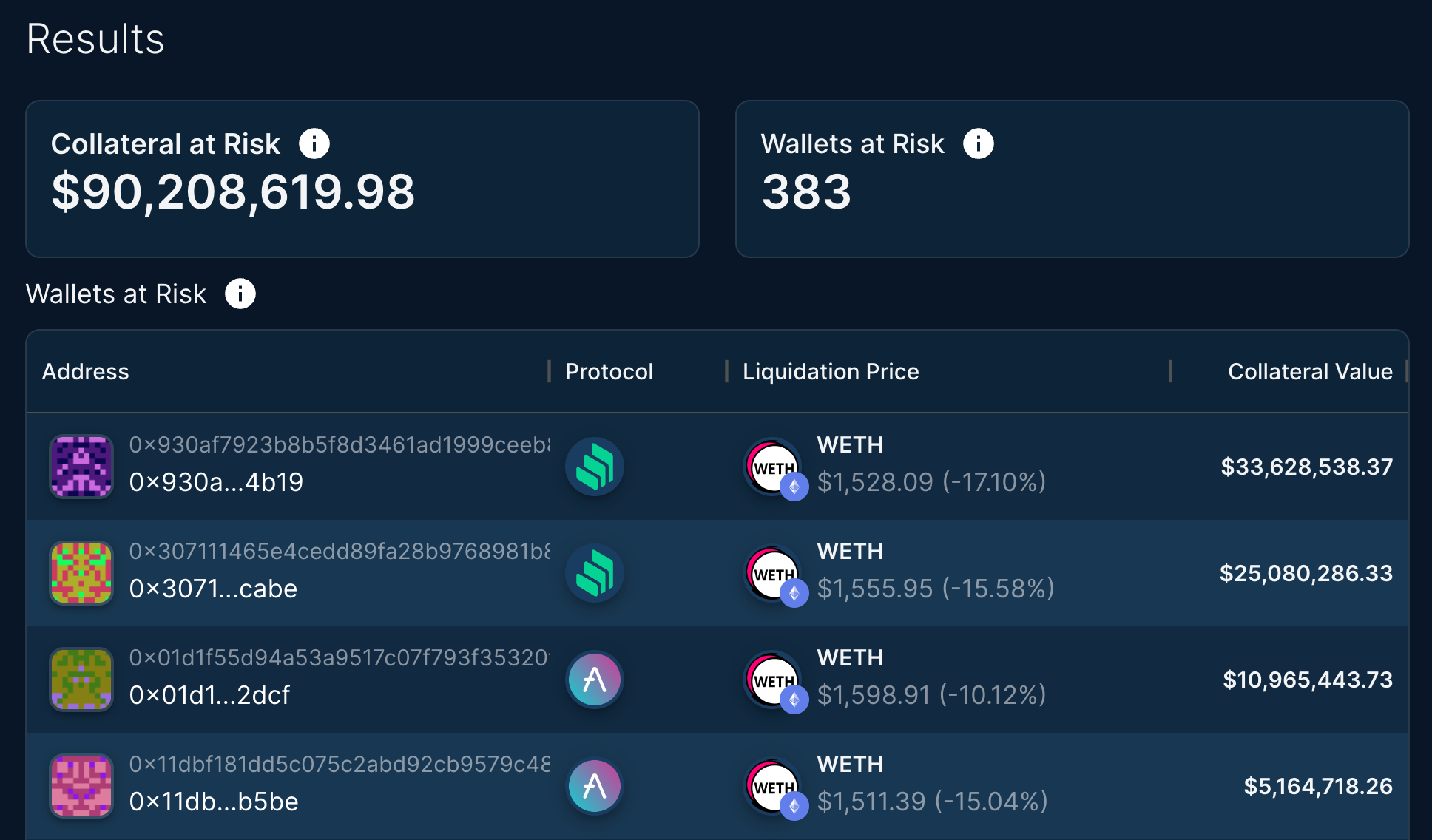

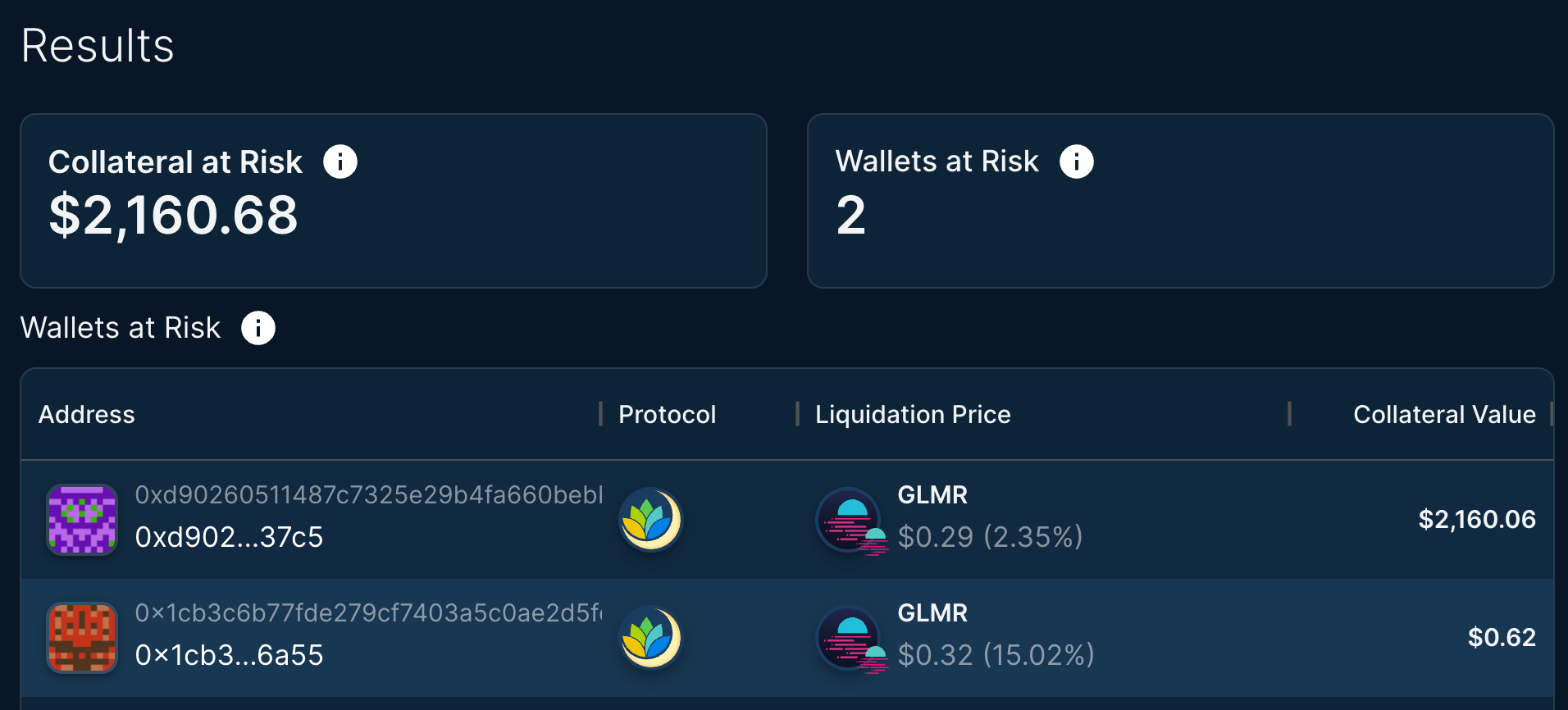

The simulation's results are displayed directly below and include:

Collateral at risk: The total amount of collateral in the accounts that would be liquidated by the scenario.

Wallets at risk: The number of wallets that would fall below the liquidation threshold.

Wallets: A list of the accounts that would fall below the liquidation threshold.

Here are some use cases that could benefit individuals and risk analysts looking to understand and manage protocol risk.

Use case #1

Simulating Depegs

A popular lending strategy on lending protocols involves borrowing ETH against stETH in a recursive manner. Since these assets are highly correlated, this strategy maximizes leverage and staking rewards.

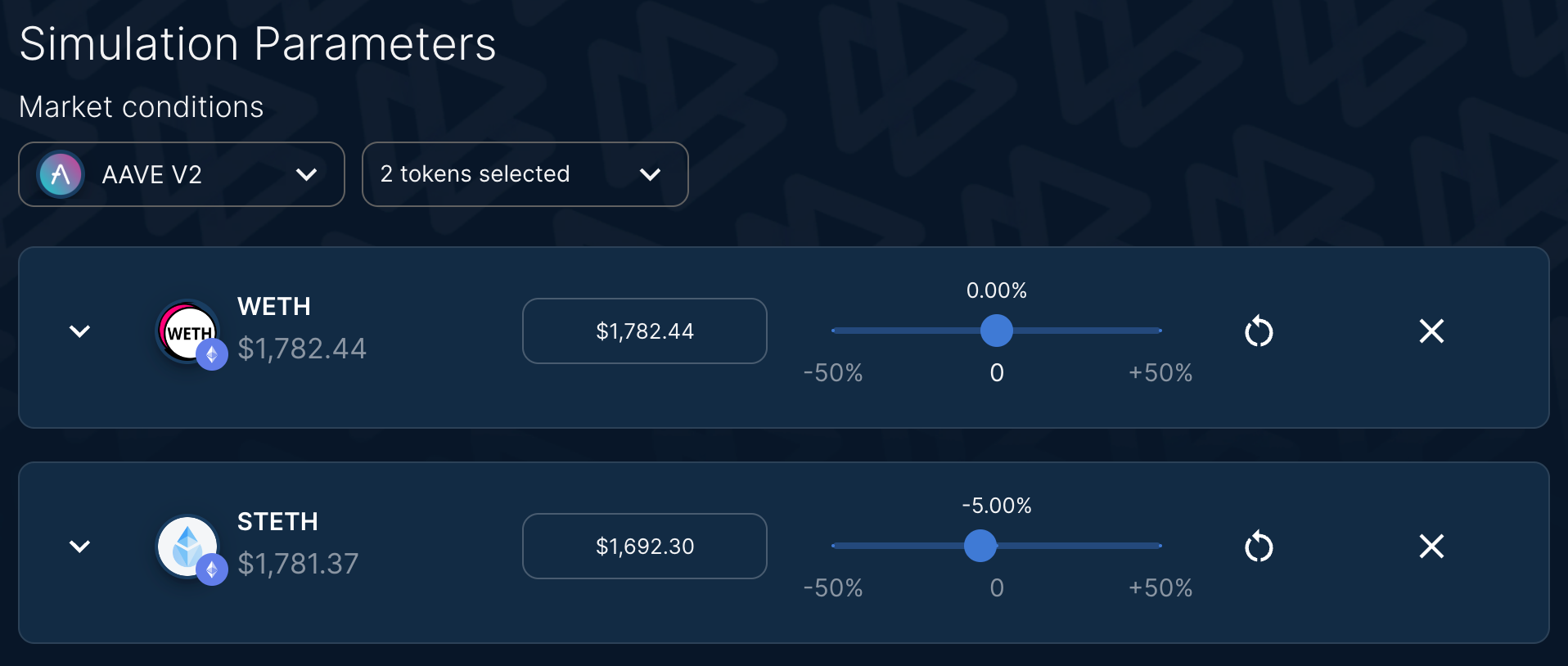

However, what happens if there is a depeg in the prices of these assets? Let's assume a 5% change in the price of stETH on Aave and analyze the impacts on the protocol and leveraged users.

As we can see from the simulation, a significant amount of collateral is at risk, and this should be considered when conducting risk management.

Use case #2

Quantifying the impacts of governance parameters update

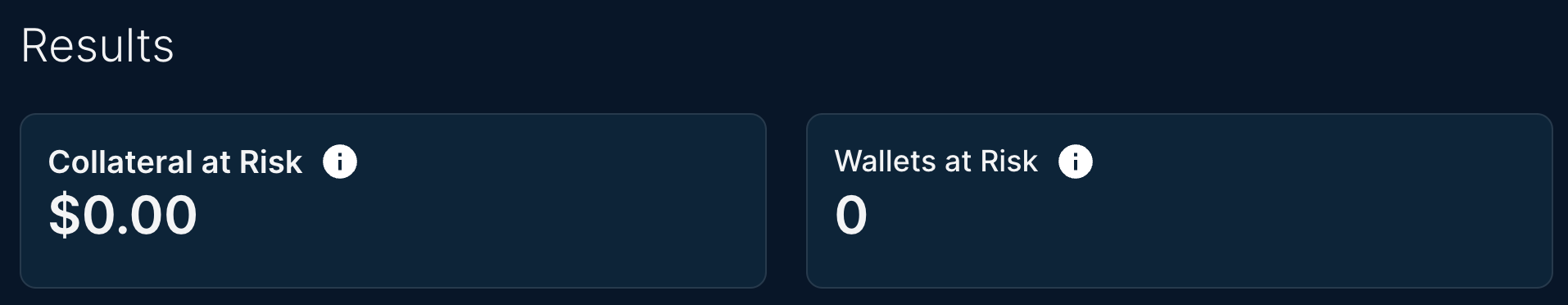

In this scenario, we aim to optimize markets on the Moonwell Artemis protocol. We assume that increasing the collateral factor for the GLMR market could make it more efficient by using more factors and models. Let's investigate the impact of increasing the collateral factor from 0.62 to 0.65 on the accounts that use GLMR as collateral:

Excellent news! With the change, no wallets are at risk of getting liquidated. However, if we increase the factor even further, some wallets may be affected and would need to be included in the proposal.

About Warden Finance

Warden Finance helps DeFi protocols identify and manage risks. We recommend parameter optimizations based on our in-house research, participate in governance, and build transparent analytics and risk tools. We’re on a mission to make DeFi data comprehensible and democratize sound risk management practices.

Website: https://www.warden.finance/

Twitter: https://twitter.com/warden_finance