The power of simulations: How Warden Finance helps you manage your crypto portfolio

The Warden website provides a powerful tool that allows users to simulate the impact of market movements on their DeFi accounts and portfolio, giving valuable insights into how their investments may be affected. In this article, we will be diving into the account simulation feature and how it can be used to secure and manage your positions.

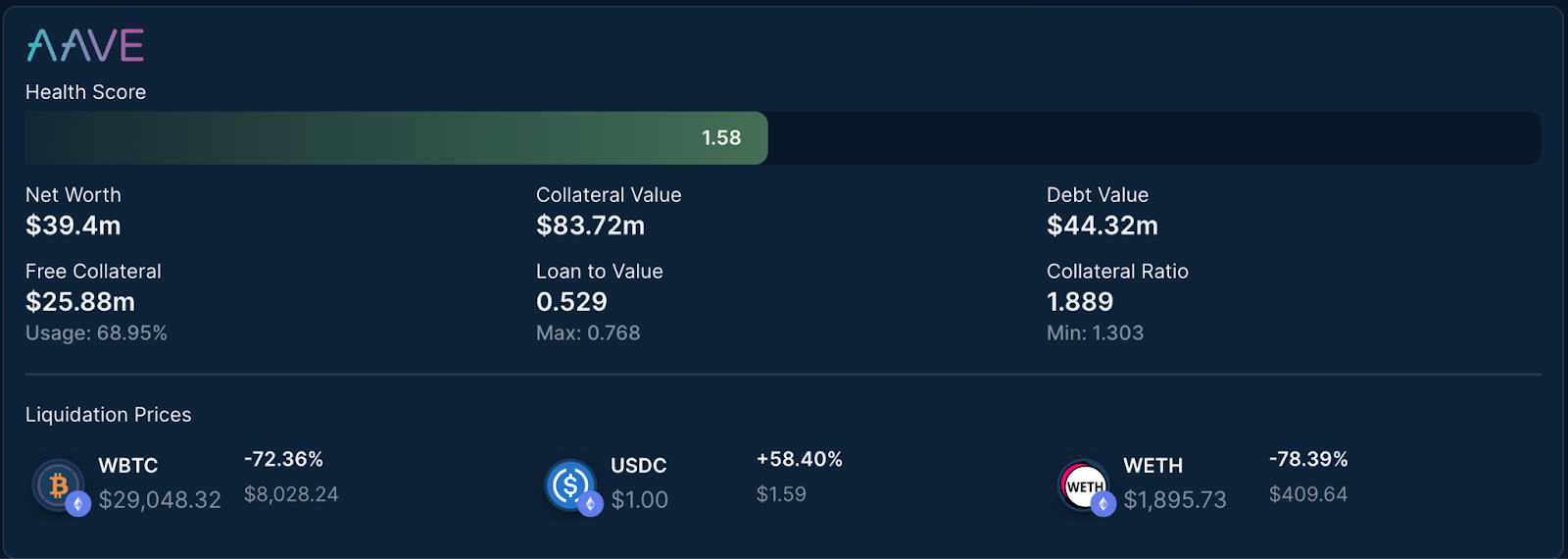

When accessing the account page on the Warden platform, users can view essential health and risk metrics presented in a protocol-based format. The platform calculates liquidation prices, indicating the threshold at which an asset will be liquidated. Even if this isn’t 100% accurate given the high correlation of DeFi asset prices, this information provides a quick glance overview of an account's health.

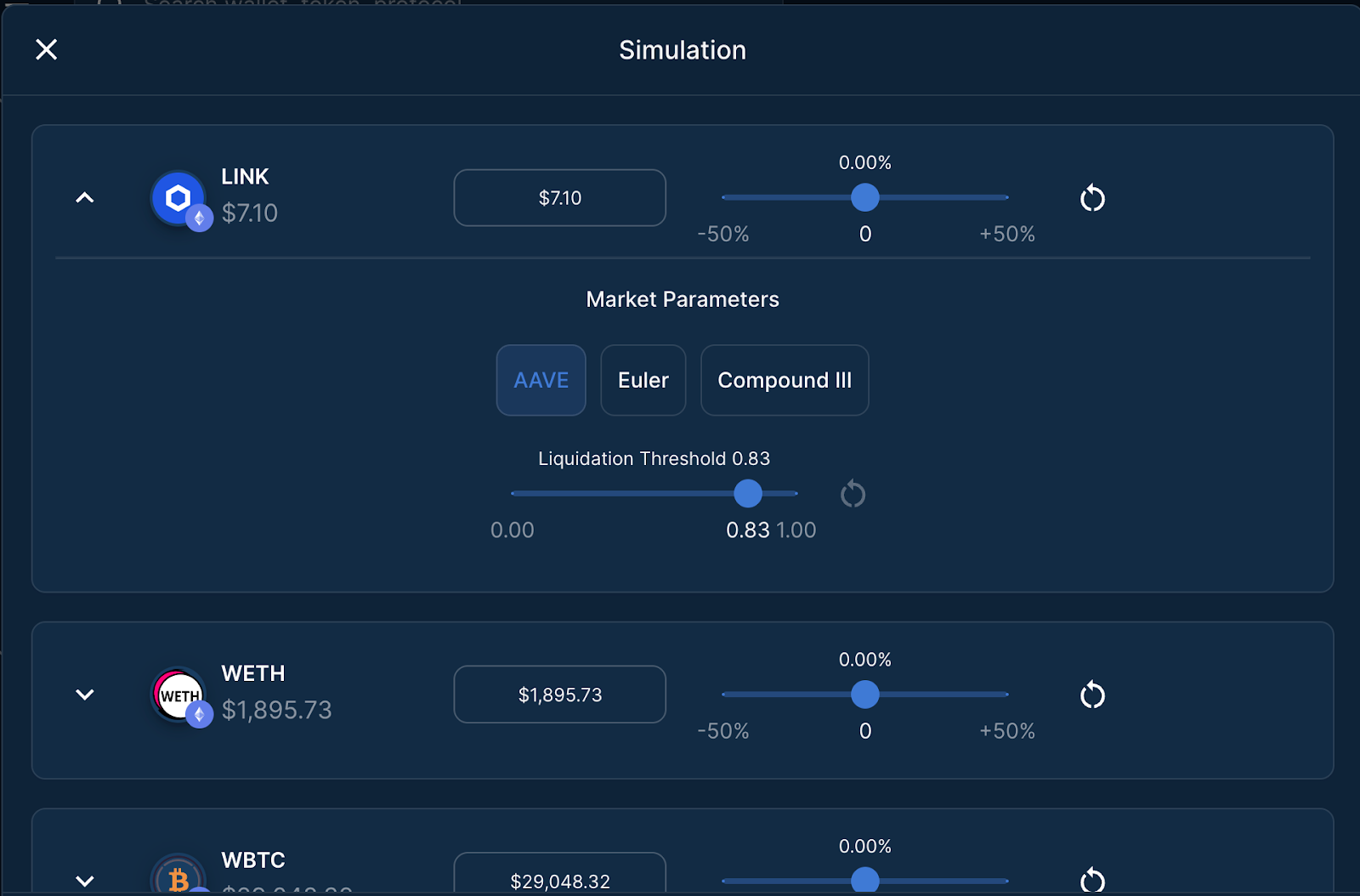

While this view provides a tidy way of assessing risk, Warden also provides a simulation tool to see the impacts of asset pricing and governance parameters changes on the account. The simulation feature is easy to use and provides a way to input asset prices and see the impact on the account’s health:

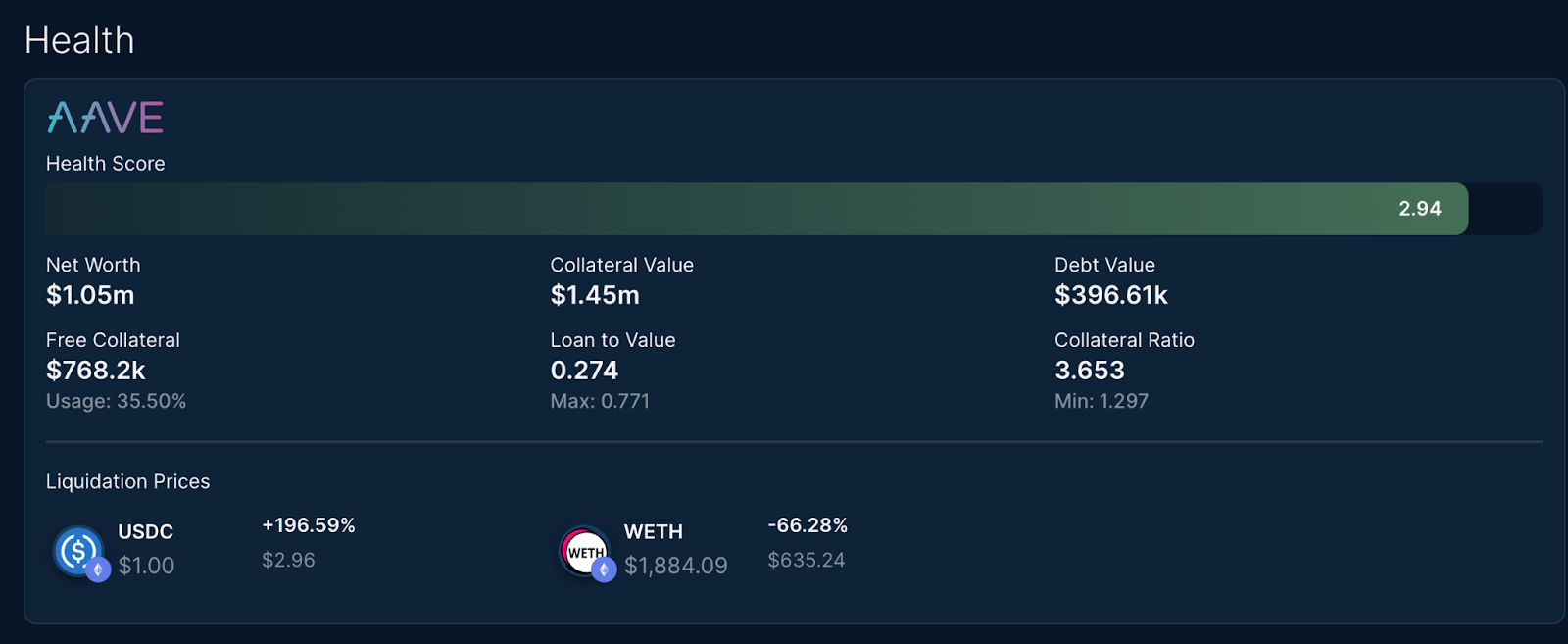

Once filled, Warden will display the simulated state of the account and update all of the displayed positions and risk profile:

Let’s highlight a couple of use cases that could be beneficial to individuals looking to manage their account’s health and avoid liquidations.

Use case #1

Managing collateral

For this use case, we will pretend to be a user that is wondering how much collateral should be kept to reduce the risks of liquidation while not having to rebalance the account more than once a day.

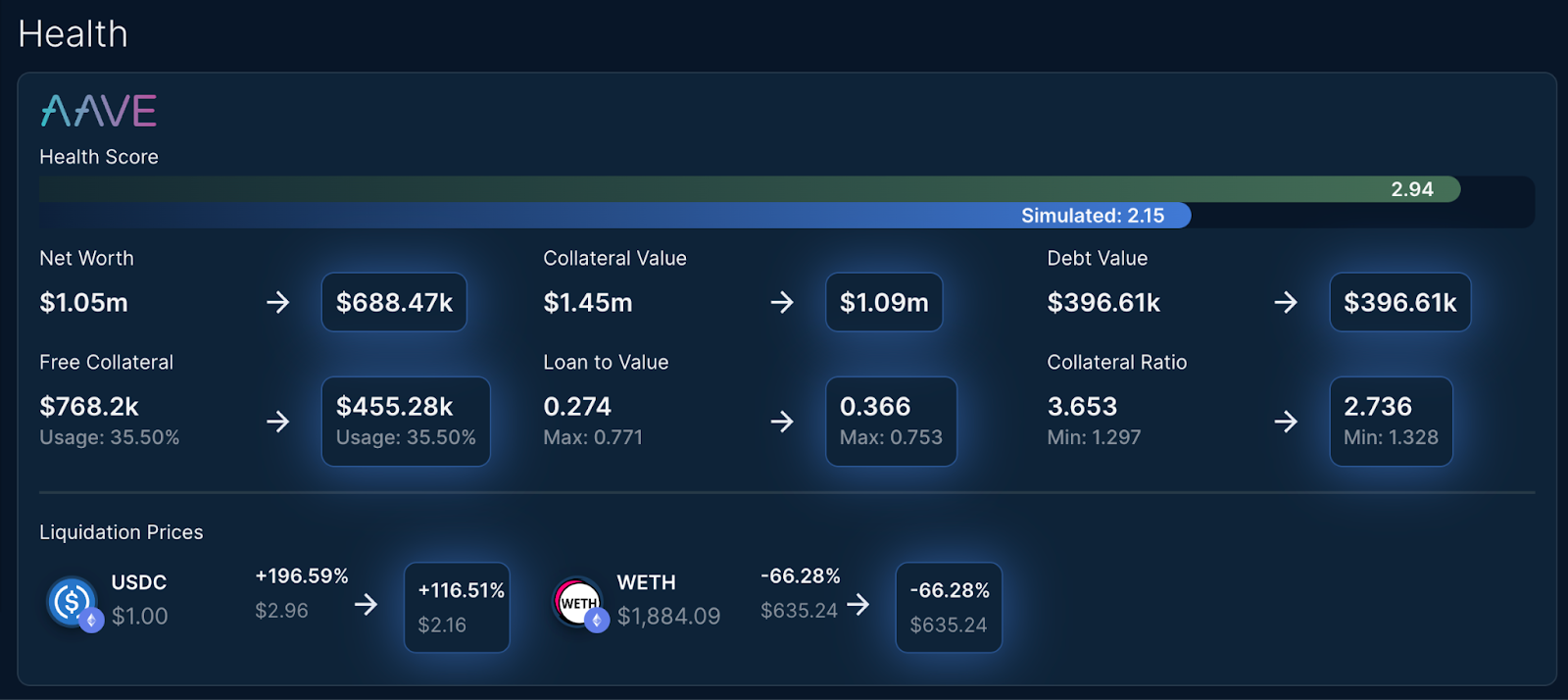

Our account has a pretty simple strategy, we borrow USDC against WETH, but our position is not optimal as we are well over collateralized and some of that WETH could be put to better use:

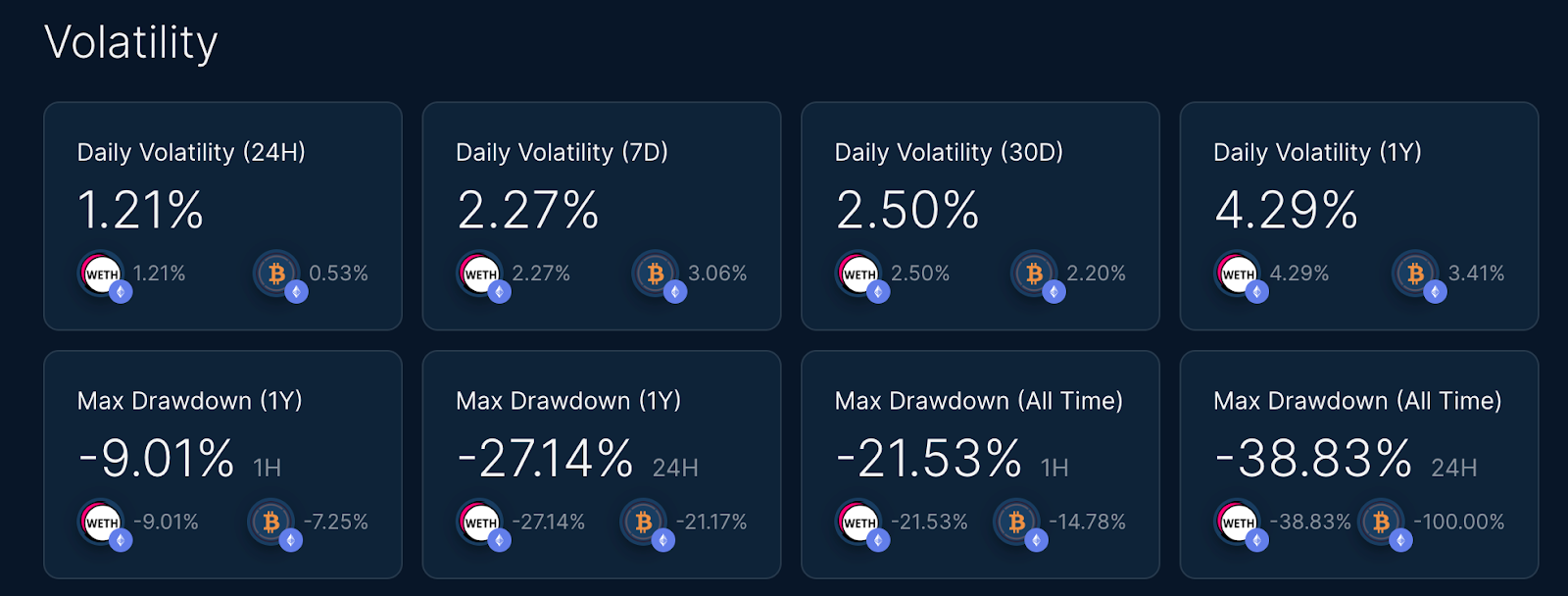

By using Warden’s Token Onboarding tool located here, we can quickly see that the worst ETH price drop in a day in the past year has been -27.14% and the daily volatility is about 4.29%:

By inputting the worst case scenario in the simulation tool, our account remains well collateralized, we should consider withdrawing some of that collateral WETH:

Use case #2

Quantifying the impact of governance parameters updates

For this example, let’s say that your favorite risk team submits a proposal to update the liquidation threshold on Aave for an asset, to reduce systemic risk as the liquidity of the asset is getting lower.

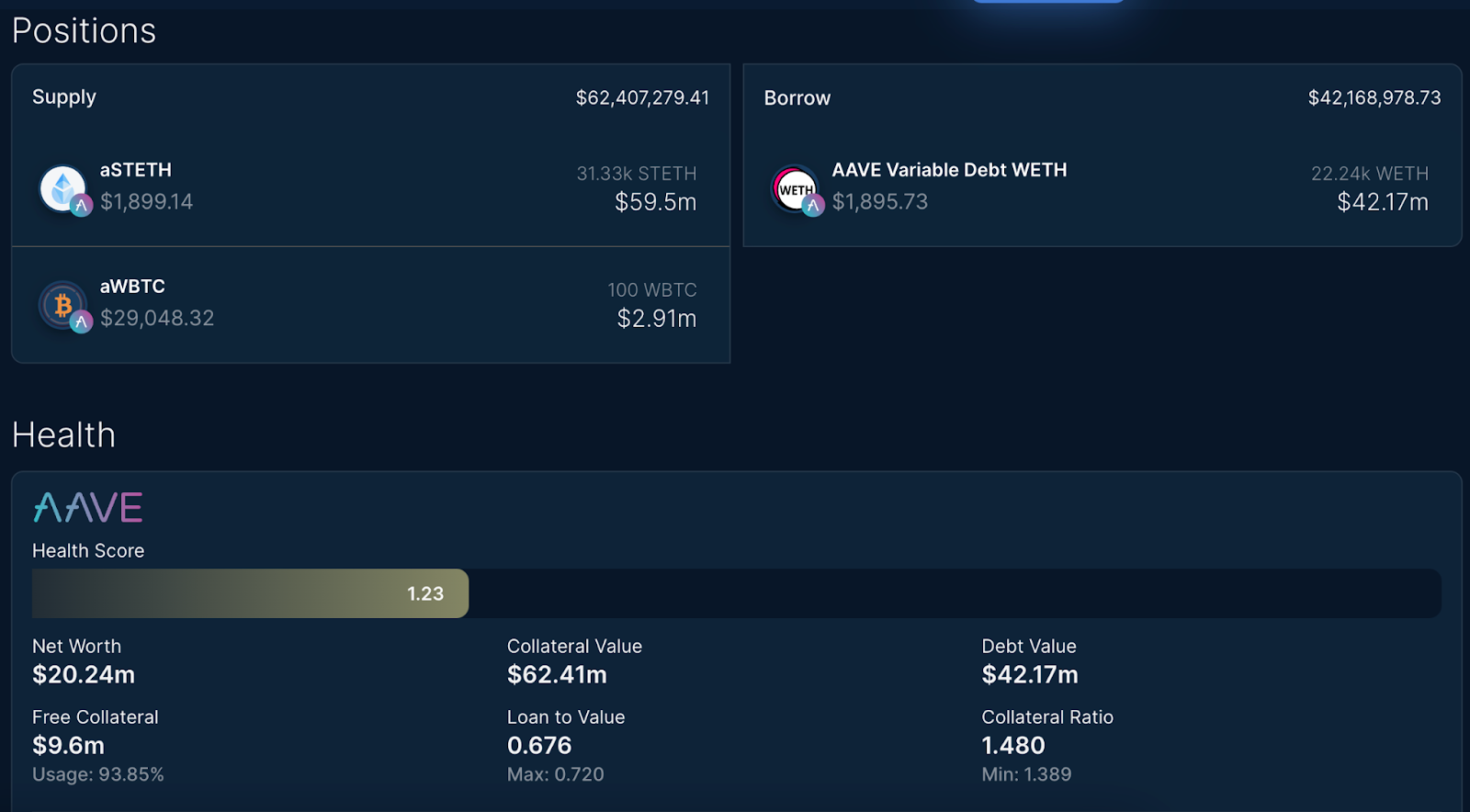

In this example, our user is borrowing WETH against stETH as a leveraged long strategy. The account’s initial health score is healthy:

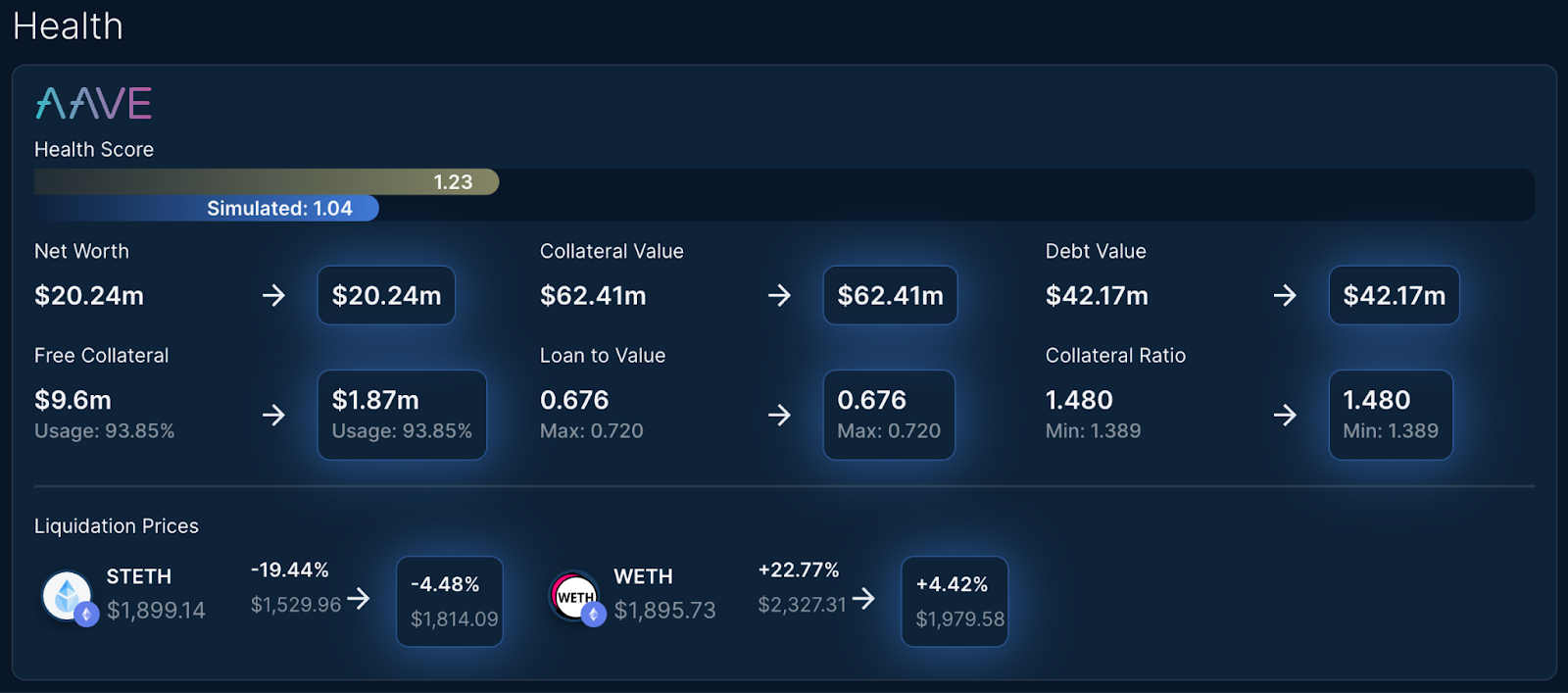

After inputting the proposed change, which is reducing the liquidation factor from 0.84 to 0.7 for stETH on the simulation panel, we can see that the account health is heavily impacted:

While the risk teams usually make sure that no account is getting liquidated, or leave users enough time to rebalance their positions when making governance parameter changes, it can leave some accounts on the brink of liquidation. In our example, the user would be exposed to more WETH stETH depeg risk as a change in 4.48% would make the account liquidatable.

About Warden Finance

Warden Finance helps DeFi protocols identify and manage risks. We recommend parameter optimizations based on our in-house research, participate in governance, and build transparent analytics and risk tools. We’re on a mission to make DeFi data comprehensible and democratize sound risk management practices.

Website: https://www.warden.finance/

Twitter: https://twitter.com/warden_finance